Market FAQ’s

1) Does the Trump Bump only apply to Palm Beach? Or will we see increased national trajectory?

Mar-a-Lago has now been dubbed ‘The Power Center of the Universe’ by the media and locals have seen Jeff Bezos and Elon Musk in town shopping for homes on Palm Beach. The local luxury market is heating up coming into the new year after a slow 2024. But does the ‘Trump Bump’ only apply to Palm Beach?

With the election over, we have some uncertainty mitigated, and expect to see momentum return to the general market.

The Dow had a historic day immediately after the election, and the Fed dropped rates another 25 bps last month, thus setting the stage for Buyers to feel a sense of comfort in their decision-making.

However, this traction comes as a Catch22. The last window of opportunity to aggressively negotiate price is quickly closing, especially in markets like Palm Beach which benefits directly from the Trump election.

My advice would be to put in aggressive offers now; with closings before year-end. We expect mortgage rates to drop once the market picks up (due to demand for loans), so even though they are still hovering around 7%, the Trump Bump should put the wheels in motion for declines.

2) Why are average mortgage rates still above 7% even after the Fed cut rates 75 bps? When will we see decreases?

Long-term yields (like the 10-year Treasury yield and 30-year mortgage rate) are not directly set by the Fed’s short-term rate policy. Instead, these rates are heavily influenced by investor expectations about future economic conditions, including the labor market, economic growth, inflation, and (lastly) Fed policy.

Mortgage rates had been hovering around 6% before the two consecutive Fed rate cuts, but since transaction volume is down, demand for loans has been low. Furthermore, If the labor market were to weaken further and unemployment were to rise, it could exert downward pressure on mortgage rates.

More thoughts in video below.

3) Is there really an inventory shortage? Or a mismatch of expectations and product availability?

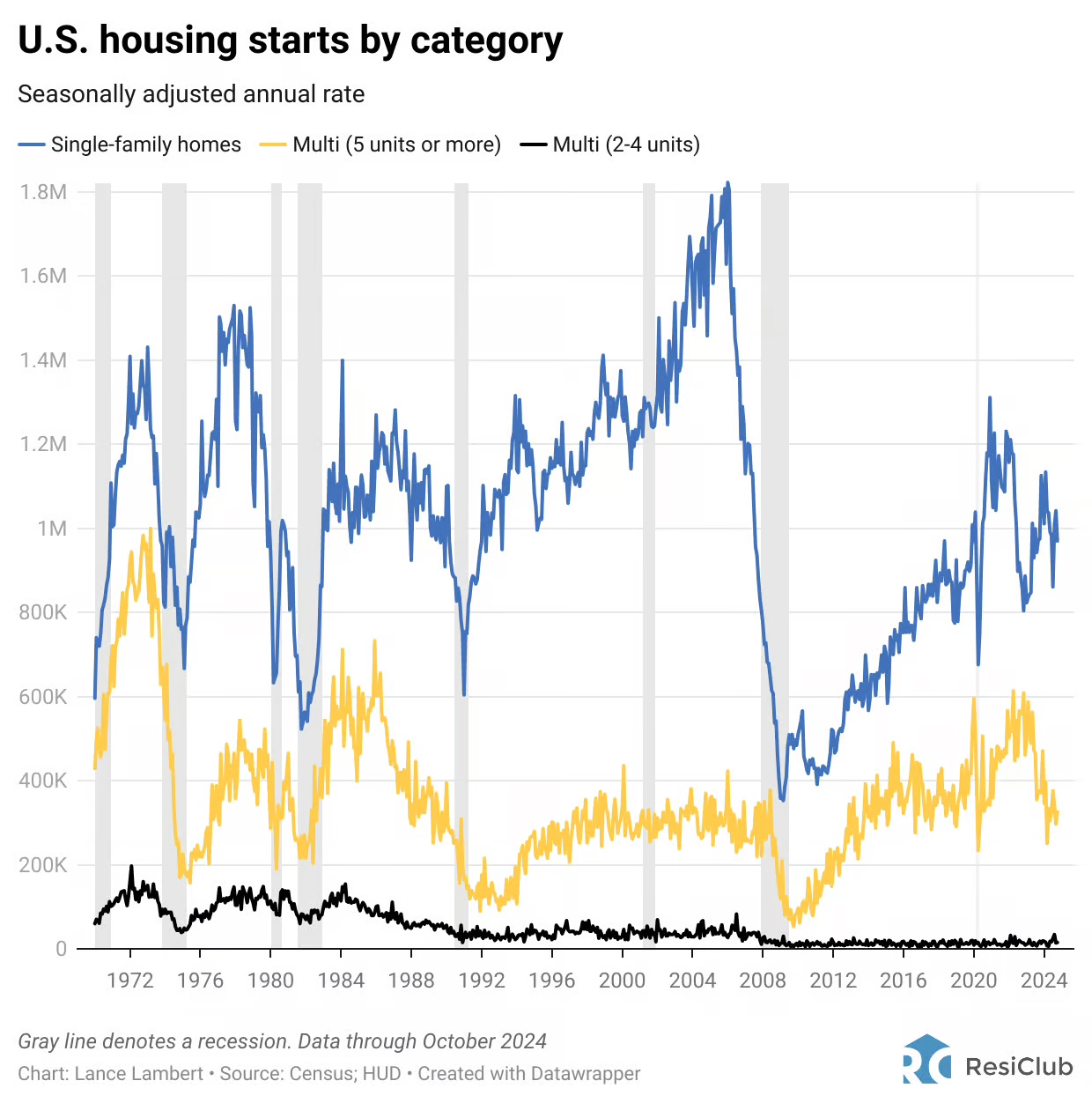

Developers had focused on building multifamily (condos/rentals) to solve the inventory shortage ‘efficiently’ but the consumer wants single family homes, so much of the inventory that has been sitting on market is misaligned with these desires.

In August 2024, only four states had returned to pre-pandemic inventory levels. In September 2024, however, it grew to seven states and in October 2024, that number grew again to eight states.

More thoughts in video below.

4) Is home ownership the new flex for generational wealth?

The average age of homebuyers in the US has risen by 6 years since July 2023; another sign that younger Americans are being priced out of the market. The average age of home owners is now 56, up from 49 in 2023 and 42 in 2010. The share of first-time Buyers also dropped from 32% to 24%, nationally.

Home ownership remains the #1 way to build generational wealth in the United States.

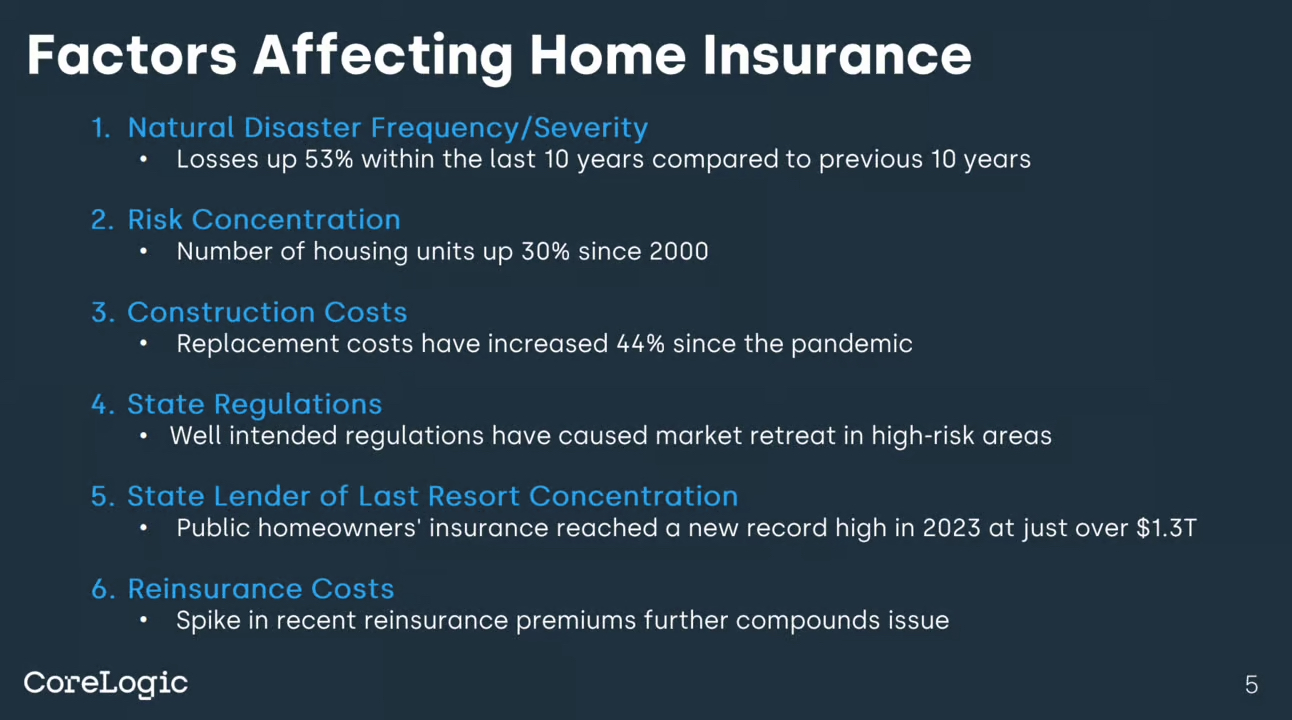

5) What are the main factors affecting home insurance prices?

Golden Triangle Market Report - November 2024